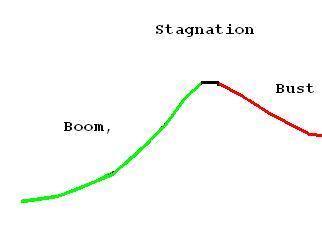

The stagnation period that was the norm in most bubble markets is no longer the norm. Small price declines are now the norm in the bubble markets. The housing boom will go bust in 2006. Price declines in most bubble markets are expected to be between 3 - 10% ( inflation adjusted) in 2006. The smart money has already exited.

There will be much pain for those who are inevitably going to be losing money. In every speculative episode those holding the bag will get burned. It won't be pretty. The housing bust has started.

Chip,

ReplyDeleteYou seem to agree with me a lot. :-) Which area are you from?

David -- there are several types of people out there looking for advice or predictions on real estate prices going forward: speculators; long-term investors; and ordinary people just looking to buy a home. For long-term investors and simple homeowners, there is no great worry that I can see. As long as you are prudent (don't overextend; and get a fixed rate mortgage) you can ride out any possible correction. Only those that HAVE to sell - due to job loss etc. will be hurt in a downturn. During the past 20plus years, I have been in all 3 categories. I bought 7 or 8 properties in the very late eighties (the peak of the last frenzy). Sure, I was underwater for a number of years. I just buckled my seatbelt and hung on. Home prices may drop but rents will not. As far as our personal residence; when we wanted to move-up in 1993, we were unable to sell without giving the house away. We simply leased it out and got a terrific deal on the new place. Yes, there was some negative cash flow for awhile - but over the past twelve years the tenants paid off a good chunk of the mortage and we received tax breaks in the form of depreciation. Sorry to be so long-winded here and the long paragraph (I don't know how to make new paragraphs on tne computer). I just don't think panic or reluctance to buy are in order here. Sure, anyone (including me), has severe heartburn when the house across the street sells for 20% less than you paid, but it is not a reason ( based upon historical data) to not buy now. Anyone have some thoughts on this?

ReplyDelete